Special Report: Listen to the Music

In a world fixated on AI, it’s time to tune into a different market rhythm. Let’s step away from the AI frenzy and explore the undercurrents shaping the investment landscape. Are there hidden opportunities amidst the noise? Read on as we decipher the market’s melody, uncovering potential paths to success beyond the AI hype.

In the ’70’s, Michael McDonald and The Doobie Brothers released a number of great hits. One of those hits was “Listen to the Music” which was released in ’72 on the Toulouse Street album. This ties in with our theme for this newsletter where we are suggesting that you listen to the Markets.

Don't you feel it growing, day by day

People getting ready for the news

Some are happy, some are sad

Oh, we got to let the music play

What the people need

Is a way to make 'em smile

It ain't so hard to do if you know how

Gotta get a message

Get it on through

Oh now mama, don't you ask me why

Whoa, listen to the music

Whoa, listen to the music

Whoa, listen to the music

All the time

Well I know, you know better

Everything I say

Meet me in the country for a day

We'll be happy

And we'll dance

Oh, we're gonna dance our blues away

While it may appear to be February 2nd (Movie reference: Groundhog Day), every day as the AI (Artificial Intelligence) craze continues to dominate the US Equity markets, the markets are speaking – who is listening?

2024 continues to have a narrow group of stocks that are taking the indexes higher, and that group continues to get smaller. Nvidia has been the most talked about stock over the past 3 years. It has been up well over 30% in just the 2 weeks following a stock split according to The Motley Fool on June 16, 2024. There are a couple more names as well. There are a few reasons for this type of market activity, and some are less obvious:

- AI is All the Craze at the moment and taking the investment oxygen out of the air.

- Portfolio managers are fearful of a recession and hiding in the larger, more liquid names.

- Introduction and activity in the One Day Expiring Option market.

Let’s expand upon that last point. First: What is an option and how do they work? The concept of options has been around for a very long time. Investopedia credits the Greeks who use options to speculate on the Olive harvest.

So, an option is a contract between two parties giving the option holder the Right to Buy or Sell a set number of shares (stocks) at a predetermined price in the future. In the 90’s, the 3rd Friday of the month was Option Expiration Day. Options trade similar to a stock, but they have a limited time to exist. Often farmers use commodity options to hedge their crops.

Why would anyone trade options? Some trade them as a way to hedge risk. Some trade them as a way to speculate. For the speculator, they can control a large value of stock by putting up a small amount of money compared to the overall value of the security.

Recently things have dramatically changed. In Sept ’22, Chicago Board of Options Exchange opened the market Zero-Day Options. This is pure gambling. Note July 2024 Barron’s cover.

Ok, speculators are speculating, that has been going on since long before the Dutch Tulip market. How is that impacting the markets? There is more than one market for stocks. The New York Stock Exchange, you know the images we see with guys with loud jackets screaming and flashing gang signs (much more electronic now) have specialists that match buyers and sellers of stock. This may be similar to an auction.

The NASDAQ (National Association of Securities Automation Quotation) is comprised of Brokerage Firms that act as “Market Makers” for shares of stock with computerized trading. These firms pledge to hold an Inventory of Stock for the companies for which they are Market Makers. This ensures that there is a fair, accurate and liquid market for NASDAQ listed firms. Think of a Market Maker as a grocery…they have to keep inventory where an auction matches buyers with sellers.

Options can cause a little anxiety in the system. When speculators buy heavily on a particular stock with call options (betting a stock to go higher), the “Market Maker” often goes into the open market to buy stock to hold in reserve in the event that a stock reaches a particular strike price. The challenge for the Market Maker is to maintain the appropriate amount of stock in inventory so they don’t hold overpriced securities. This is a complex system.

Let’s return to Market Music.

The world beyond AI stocks has seen significant declines and, in our opinion, offers much better risk/reward prospects. Anyone who has been in the securities business for longer than 20 minutes has heard the Dow Jones Transportation Index (a basket of companies including: Airlines, Trucking, Shipping and Rail) is a leading market indicator.

This 10-year chart shows the pain of many companies following a brief Covid recovery.

Off their local highs Delta DAL -14%, United UAL -17%, Southwest Air LUV -22%, and American AAL -32%. The U.S. government says TSA data looks fine, yet the Transports keep underperforming. The TSA has daily data near the recent highs for the number of people scanning their boarding pass with a TSA agent, and it continues to show no signs of the economy slowing down. “Friday, June 28th, was the 4th busiest day ever for TSA – our officers screened 2.93M individuals at airports nationwide.” According to The Bear Traps Report July 7. 2024

***JETS is an exchange traded fund that tracks along with a collection of airline stocks.

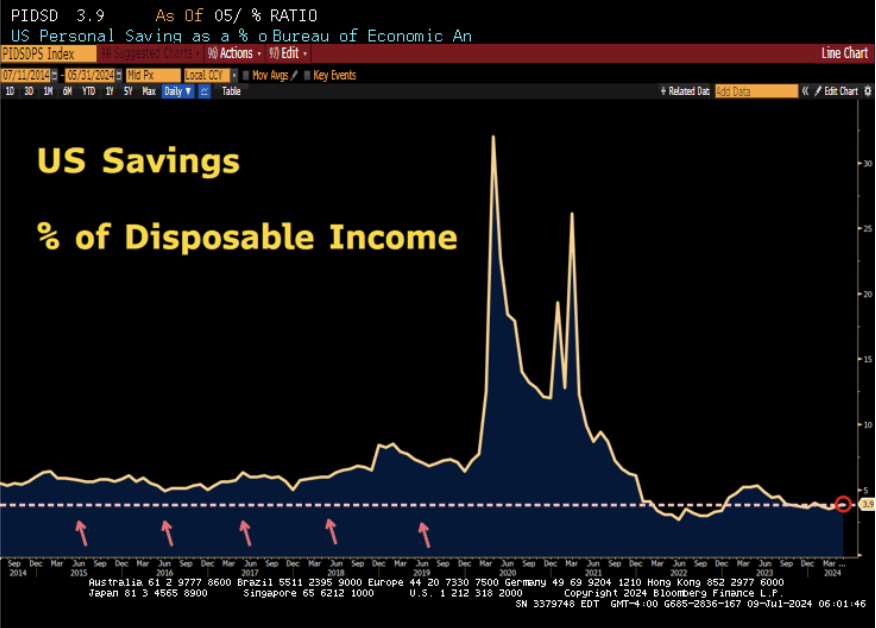

Total Credit outstanding rose $11.4 billion after a revised $6.5 billion gain in April, according to Federal Reserve data released Monday. The median forecast in a Bloomberg survey of economists called for an $8.9 billion increase for May. The figures aren’t adjusted for inflation. Revolving credit, which includes credit cards, advanced $7 billion, also the most in three months. Non-revolving credit, such as loans for vehicle purchases and school tuition, increased $4.3 billion. Many Americans who have whittled away their pent-up savings accumulated during the pandemic are relying on credit cards and other payment methods to spend. Combined with the rise in the cost of living, that’s further straining household finances and points to a slowdown in consumption. That may explain a recent pullback in consumer spending. Retail sales barely rose in May and prior months were revised down, according to the latest data. The monthly consumer credit report doesn’t include mortgages." – BN

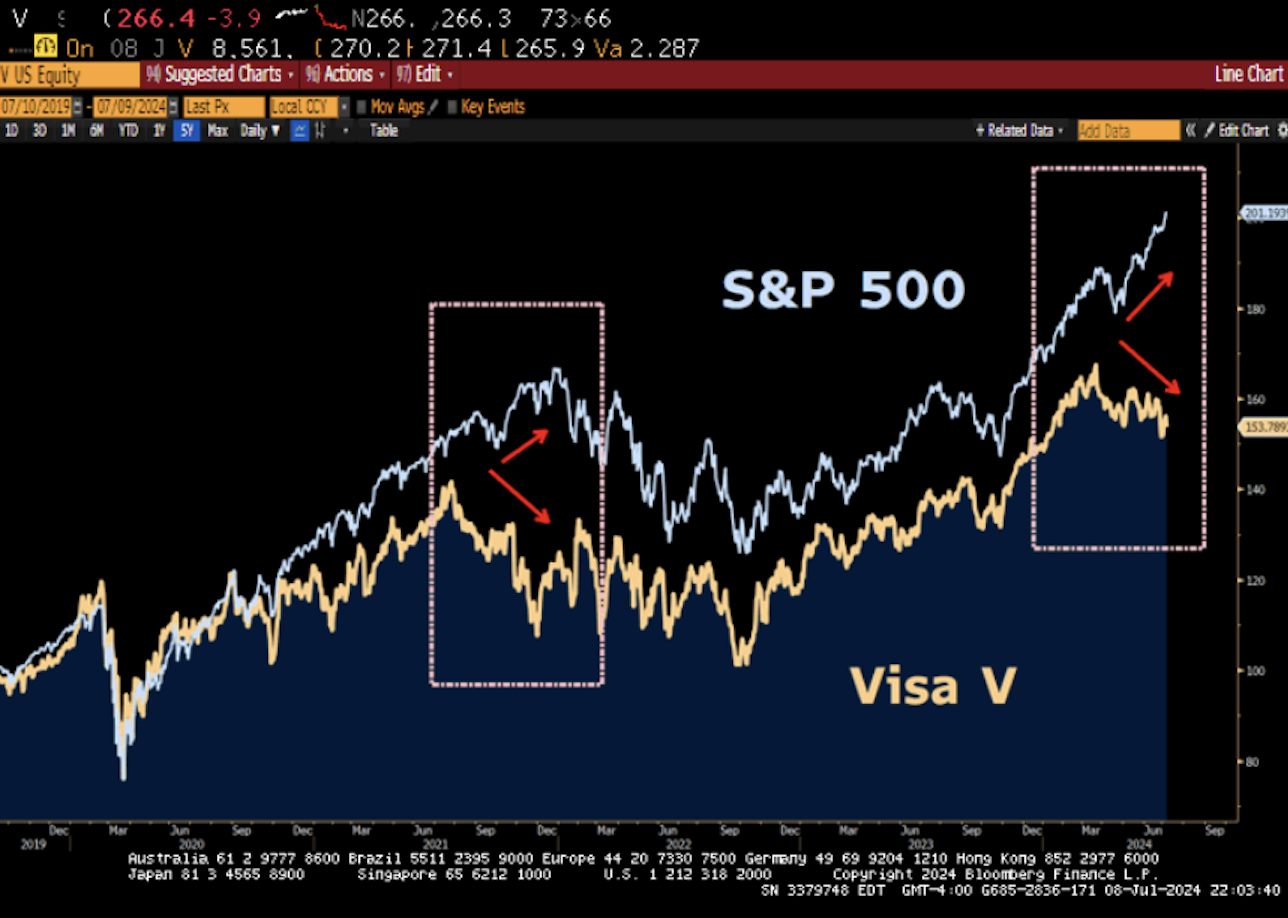

The markets have taken notice. Here are the 5-year charts of Visa and Capital One. Both have had significant divergence from the S&P 500.

With all of this negative news are there any opportunities? Yes! Again, if we Listen to the Music, the World is full of opportunities. Now is the time to seek them out!

The World, like the US, is waiting to see how our elections play out. We believe there are several places to find value well before the election. Think back 8 years. November 9th, the pundit was predicting Doom and Gloom for the United States. Donald Trump was going to take us back to the Stone Ages with his protectionist policies and the markets were sure to crash. The opposite was the result and DJIA and S&P rocketed for the following several months.

Election

Regardless of which party takes power in November, we believe opportunities exist. While nobody has a crystal ball, buying great companies that trade at a historically cheap price compared to future earnings has proven to build wealth. In our opinion, there are great opportunities in the metals, apparel, food, large companies overseas. This report is not a suggestion to purchase shares of any company listed above. However, we do find opportunities in today’s market. Contact us for more details.

May this report be music to your ears!

**All charts and company specific analysis are compliments of The Bear Traps Report & Larry McDonald.