Special Report: Electric Avenue

In 1982 while some of us were in high school, the Guyanese-British singer Eddy Grant released his best single, Electric Avenue. The song is about the civil unrest a year earlier in London. The song title comes from a sign at a movie theater in the Brixton neighborhood. It is the word “Electric” that is the focus of our letter.

Boy

Boy

Down in the street there is violence

And a lots of work to be done

No place to hang out our washing

And I can't blame all on the sun, oh no

We gonna rock down to Electric Avenue

And then we'll take it higher

Oh we gonna rock down to Electric Avenue

And then we'll take it higher

Workin' so hard like a soldier

Can't afford a thing on TV

Deep in my heart I'm a warrior

Can't get food for them kid, good God

We gonna rock down to Electric Avenue

And then we'll take it higher

Oh we gonna rock down to Electric Avenue

And then we'll take it higher

Oh no

As we stroll through the middle part of this decade, most Americans and even citizens abroad have very little knowledge of how life is likely to change. Sure, we have heard all of the chatter about AI (Artificial Intelligence). We have read stories about Crypto currency. And some of us may own an EV (Electric Vehicle). Gee, Patriot, those items are in the news a good bit but what do they have in common? The answer…. ELECTRIC.

We appear to be barreling down the highway at a high rate of speed into a potential energy crisis. For the past 15 years we have been spending a bundle of money on alternative sources of energy. Some would argue that we have spent much of our time and resources in the wrong place. While wind and solar can help supply electricity, they are not as efficient as coal, natural gas and nuclear. After fighting clean nuclear energy for decades, many are now realizing the benefits.

We have all seen the stories of brown outs in Texas and California. We have recognized for years that our power grid is aging and outdated. What has been in the blind-spot is the rapid increase in demand for energy. Now it is staring at us in the Face. Here are a few concerns recently published in the Washington Post:

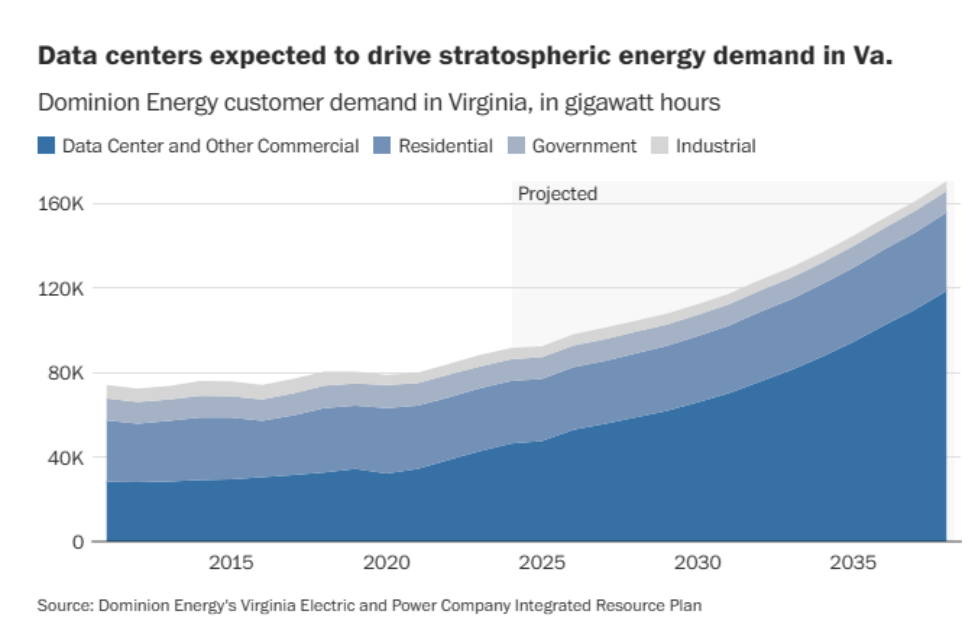

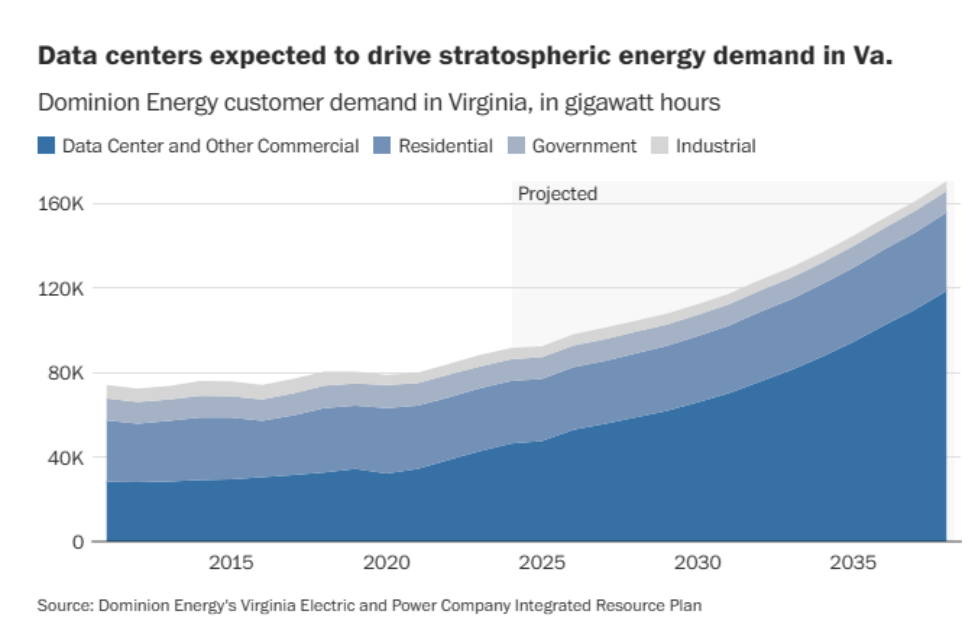

Vast swaths of the United States are at risk of running short of power as electricity-hungry data centers and clean-technology factories proliferate around the country, leaving utilities and regulators grasping for credible plans to expand the nation’s creaking power grid.

In Georgia, demand for industrial power is surging to record highs, with the projection of new electricity use for the next decade now 17 times what it was only recently. Arizona Public Service, the largest utility in that state, is also struggling to keep up, projecting it will be out of transmission capacity before the end of the decade absent major upgrades.

Northern Virginia needs the equivalent of several large nuclear power plants to serve all the new data centers planned and under construction. Texas, where electricity shortages are already routine on hot summer days, faces the same dilemma .1

According to our friend, Larry McDonald2 , the combination of AI & Crypto is having an explosive demand on energy usage. Using semiconductor company, Nvidia’s projected sales growth, the energy usage of these two industries will go from 460 Terawatt Hours in 2022 to 1500 Terawatt Hours annually in 2026. For some perspective, that is near the equivalent demand usage of Germany and France combined just for two industries that were unheard of just two decades ago.

We don’t have to go far here in Central Ohio to find the energy users. Johnstown, New Albany & Pataskala are littered with giants. On Beach Road you can find Data Centers for Facebook/Meta, Google, Microsoft, and Amazon. That is just one little patch of land. There are many more throughout the region. Now multiply that throughout the globe.

Per Bill Gates (Microsoft founder), the world adds a new data center every three days – explosive demand is coming. “We’re not going to build 100 gigawatts of new renewables in five years. You are kind of stuck”, said Gates. In a recent Washington Post article, the five-year projection of U.S. electricity demand growth has doubled from a year ago.

To compound the strain on our grid, there has been a significant effort to “re-shore”/”build” in America” since the pandemic opened our eyes to the vulnerability of the supply chain. You can see that reflected in Central OH with the Intel project and the passage of the “Chips Act”. There is not only strain on the grid, but also on our wallets. In June of 2023, AEP had a rate increase of 28% according to the Columbus Dispatch. There is much work to be done.

Net Zero Is Too Expensive

This transformation to “alternative” energy will take decades, not years and will not arrive in the time frames governments project.

Since 2018, the subsidies and investment into Alt Energy is over $2.2 Trillion. For this “investment”, clean energy performance has declined by 20% annually3. Even with this substantial investment, coal still provides more energy than wind and solar combined. Future projects will materialize even slower in a higher global interest rate environment. In a twist of irony, it will take the consumption of “old tech” fuels to build out the new projects.

To build the projects that governments have announced, will result in significant CO2 emissions. Would you believe the emissions would be the equivalent of Argentina annually and require a 20% share of the growth in energy demand. 4

If inflation has been a concern for you and your investments this could be an opportune time to take advantage of a proprietary strategy.

At Patriot, we have been talking about inflation since the summer of Covid. We developed our proprietary investment strategy and launched the Patriot Revere Opportunity Portfolio in the Spring of 2021. We believe, with conviction, that the investment landscape going forward will be significantly different from the last decade. If you have over 300K of invested assets, you may qualify for our program.

From CDs to Stocks, every investment involves a degree of risk. For details about the Patriot Revere Opportunity Portfolio, consult your Patriot Asset Advisor.

Sit back for a moment and let these numbers sink in….The energy needs for Google, Meta and Microsoft have increased EIGHT-FOLD. One ChatGPT search consumes 10x the energy of a single Google search. The coming demand on our grid is Enormous. Those who are GREEN and want the EV experience will have to open their wallets to cover the added expense.

Coffee is made from oil!

When you sit down tomorrow morning with your cup of coffee, consider what it takes for you to enjoy crushed beans. “… Coffee is made from oil. Machines to grow it and harvest it, vehicles to

transport it, more machines to pack it, electricity to roast and

grind the beans, heat to boil the water. It doesn’t happen with

pixie dust, old pal. It happens with crude oil.”

Rafi Tahmazian, Canoe Financial

We are not trying to knock nor mock those who desire a cleaner planet, we live here too. However, the transition to EV comes at a huge cost. I can’t get into all of the details, as it is beyond the scope of this letter but the search for “rare earth” material wreaks havoc in those places that are mined. For those who want more details, your homework is to research mining for the following materials: Cobalt, uranium, silver, copper, platinum, palladium, and more.

The drive to be green comes at a cost beyond the wallet. There is a significant human toll with exploitation of workers in poor countries, devastation of rainforests, and pollution even poisoning of soil and water near mining sites.

Since this is not a Science Class, but an investment newsletter, what is the play? Should we invest in a utility company, copper company, coal, or what? We are glad you asked.

At Patriot Asset Advisors, we choose to provide individual advice and avoid the cookie-cutter approach to finance. As the investment world chases that shiny object, we do our homework and look for investment opportunities that may have been overlooked. If you haven’t noticed, we are sharing it with you now….THE INVESTMENT WORLD HAS CHANGED since Covid.

The key points are the following:

- Inflation Higher for Longer - once the genie is out of the bottle it takes years to reign it in

- Government spending – often misallocation of resources

- Rising Global Interest Rate – Higher cost of capital for ALL – Governments, Businesses and Individuals

- War – Several hotspots around the world

- Reshoring/Friend-Shoring – Moving manufacturing closer to home and away from adversaries

- Currency Battles – Many foreign governments are reducing the investment in US Dollars and Treasury Bonds and the trend may lead to higher interest rates

If you are not taking these issues into consideration with your investments, we need to have a deeper conversation. At Patriot Asset Advisors, we are positioning investment money for the future. A future that has a much different investment thesis than the past 30 years.

1 Harper, E., Amid explosive demand, America is running out of power, Washington Post, March 7, 2024

2 McDonald, Larry , former bond trade for two large brokerage firms, editor of the Bear Traps Report and best- selling author.

3 McDonald, L. Bear Traps Report, March 21, 2024

4 McDonald, L. Bear Traps Report, March 21, 2024