Special Report: Is it Safe to Go Back Outside?

What a long, strange trip it has been, to quote Jerry Garcia. Do we have stories to tell our grandkids! At the risk of getting mildly political, we find ourselves in a negative feedback loop. Thirteen months ago, we penned an article accurately laying out the economic challenges we were facing for 2022.

In our letter written on Nov 14, 2021, “How will ESG Impact Your Investments”, we discussed:

- Global energy demand and prices

- Inflation

- The Federal Reserve (global central banks) and interest rates

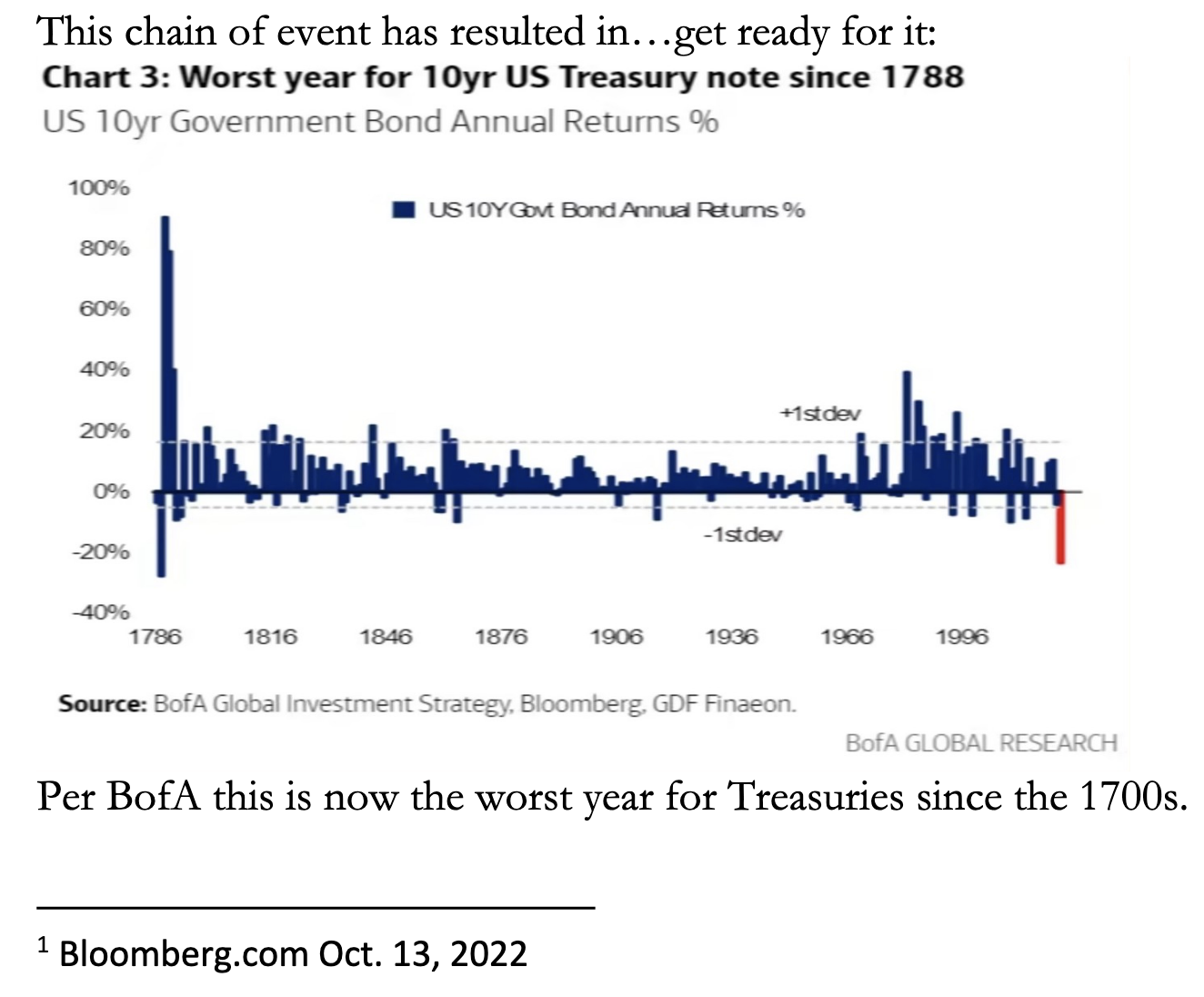

In the months that followed, energy prices rose dramatically, and the White House tapped the Strategic Petroleum Reserve to dampen stress. Russia invades Ukraine in February, sending shockwaves through the energy and food markets. Inflation is on the march to records we haven’t seen in over 40 years.

The Federal Reserve passed off the inflation story for months as transitory, as inflation gripped the US and world. The Federal Reserve then stepped in with an unprecedented 3.75% of rate hikes. However, once the genie is out of the bottle, it is hard to reverse course…kind of like toothpaste. From our letter last year:

INFLATION

Some economists are worried about a 1970 style inflation/stagflation type environment. We are not going to make predictions here. What we do see are corporate challenges including – wages (new power of labor to demand higher wages), transportation costs (supply chains), and energy costs (oil, gas, coal). This trio of issues may leave a bright red stain on corporate earnings reports.

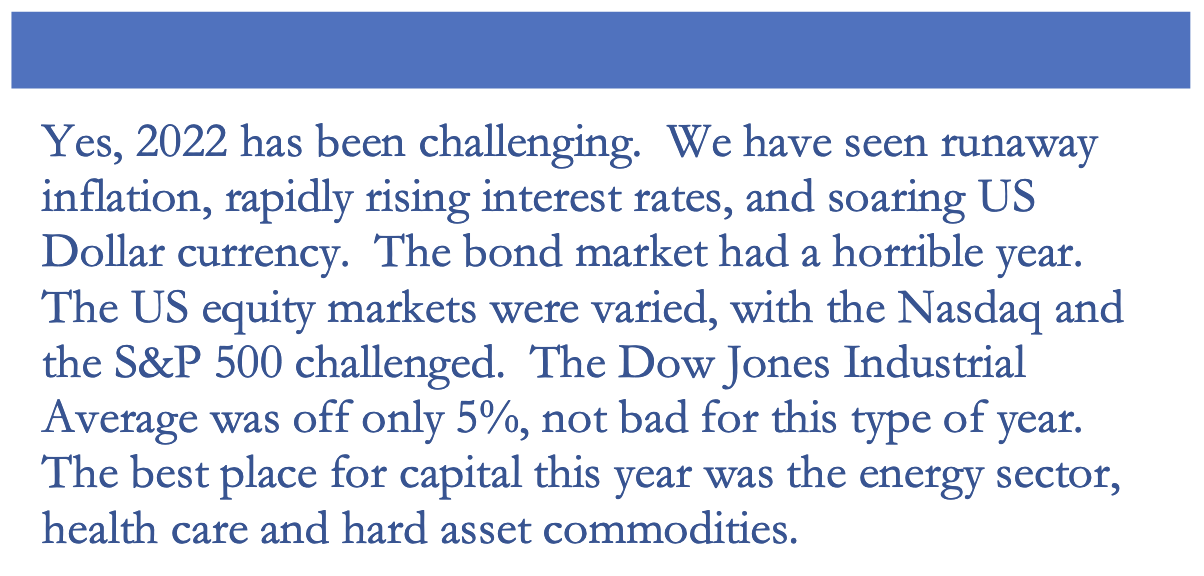

Our crystal ball of 2023 is a little cloudier. We are expecting another year of higher than usual volatility. Remember, volatility doesn’t have to always be bad. The investment markets must go through a little indigestion periodically to rebalance. Sometimes that process can be a little messy.

It is during these periods that we earn our keep. We help clients maintain proper diversification, minimize volatility, and seek opportunities when others only see pessimism. You see, it is the challenging times that present the very best investment opportunities. We can learn from people like Warren Buffett. We want to take profits when others are overly optimistic and want to be buyers when others are afraid to go outside.

For 2023, we believe unemployment will rise as the Federal Reserve rate hikes begin to set in. Again, the Fed has raised rates to cool inflation and to that end, the Fed needs to reduce employment to lessen the pressure on prices. We would not be surprised if once inflation rolls over, the Fed moves to decrease interest rates.

Since the Covid outbreak, the US debt has surged dramatically. The Fed interest rate policy will have a significant impact on the US Budget. As you know, with mortgages and auto loans, interest rates matter. They matter to the US Government too. And, if the US issues large amounts of bonds in this interest rate environment, it will get very expensive very quickly.

How to invest in this type of environment? We favor a targeted diversified approach. What does that mean? Most of the investable money should be globally diversified with a little more emphasis on international holdings. Additionally, we often recommend having a portion of a portfolio invested in a targeted investment.

Our Patriot Revere Opportunity Portfolio (PROP) is a targeted investment that seeks opportunity in areas that we believe have been out of favor with a catalyst for price improvement.

As of this writing on Dec 1, 2022, our clients that have been invested in PROP since Jan 1st of this year have had positive growth in their account. Like Gretzky, we try to position our investments so that we benefit from where the markets are going, not where they have been.

We welcome the opportunity to discuss your retirement dreams. If you would like to review your current plan or discuss investment opportunities available through Patriot Asset Advisors, please contact us at 614-944-5255. We specialize in working with people between the ages of 50 & 75.